Research

JMP

Entrepreneurship Across Cities: Uncovering Policy Implications Draft

Presented at: ECB's Young Economist Prize (finalist), The University of Edinburgh, The University of Manchester, 14th European Meeting of the Urban Economics Association (finalist at the Student Prize), Public University of Navarre (UPNA), UPF Macroeconomics and International Lunch seminars, ANEKO seminar at UPV/EHU

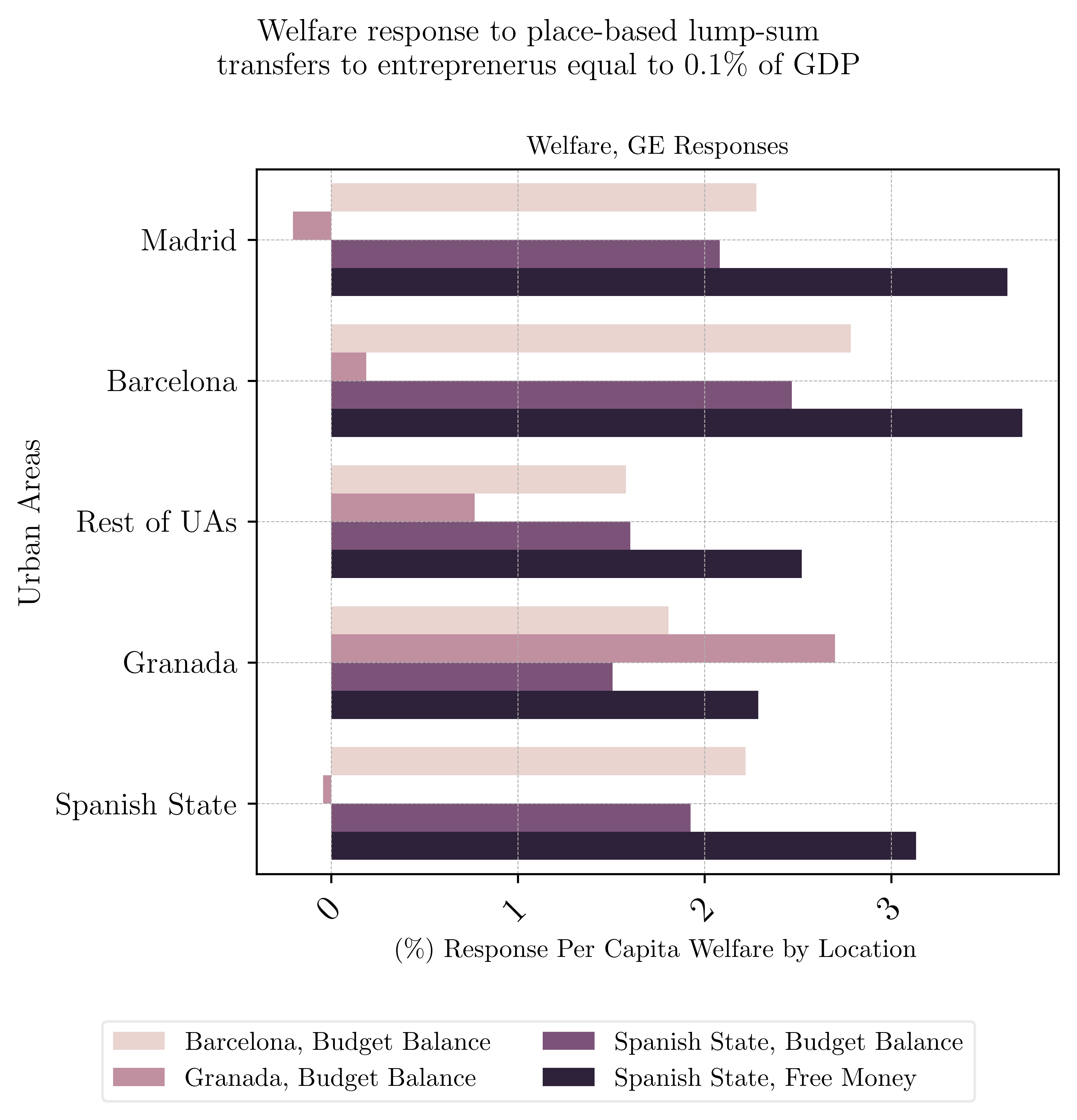

Are entrepreneurs and their capital allocated optimally across space? Should governments employ place-based entrepreneurial policies? To study these questions, we first develop a dynamic spatial quantitative framework featuring financial frictions, dynamic capital accumulation, occupational and location choice and agglomeration forces. We then take this model to the largest 20 Urban Areas (UA) of the Spanish State by relying on rich administrative and balance sheet data. A key prediction of the model, which the data supports, is that there are heterogeneous returns to capital across space, and more productive UAs are more capital constrained. Intuitively, financial frictions, albeit symmetric, disproportionately hinder more productive UAs from reaching their production frontier. Second, we provide an efficient solution method by exploiting the parallel nature of GPUs in CUDA. Speed-ups in the range of 60 to 20,000 are obtained compared to standard methods. Third, the policy analysis suggests that, compared to a spatially neutral policy, targeting a subset of the most productive UAs achieves greater welfare and production gains. However, these policies pose a trade-off to policymakers between aggregate gains and increased regional disparities.

Working Papers

Entrepreneurship, Financial Frictions and Optimal Policy Draft

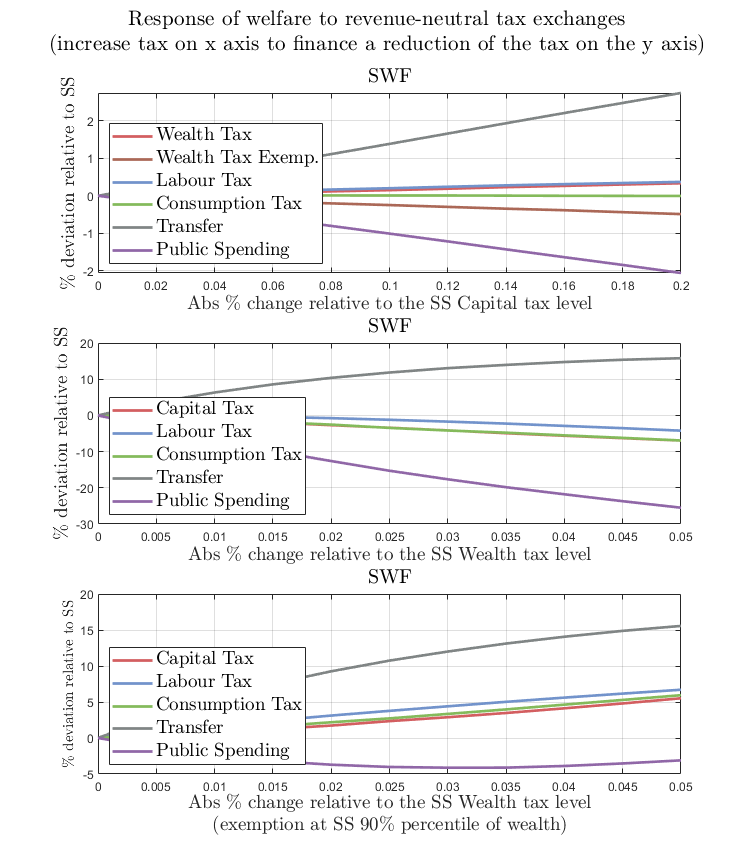

The presence of financially constrained entrepreneurs generates an heterogeneity in returns which in turn leads to a non-trivial distinction between capital and wealth taxes. We study the effects of partial reforms and optimal long-run taxation in a model that matches key U.S. economy moments on its pass-through sector and degree of inequality. Relative to the existing literature, we examine the implications of a wider set of tax instruments (including exemptions and inheritance taxes), inter-generational transmission of abilities and endogeneity of the occupational choice. We find that (i) a lower degree of inter-generational transmission of abilities weakens the welfare gains attainable through optimal policy (ii) allowing for a wider set of tax instruments, in particular an exemption on the wealth tax, leads to significant additional relative welfare gains (+30%) and shifts wealth taxation into positive territory (iii) the presence of the endogenous occupational choice dimension weakens the motive to substitute capital for wealth taxation, given the extensive margin misallocation that it entails.

Work in Progress

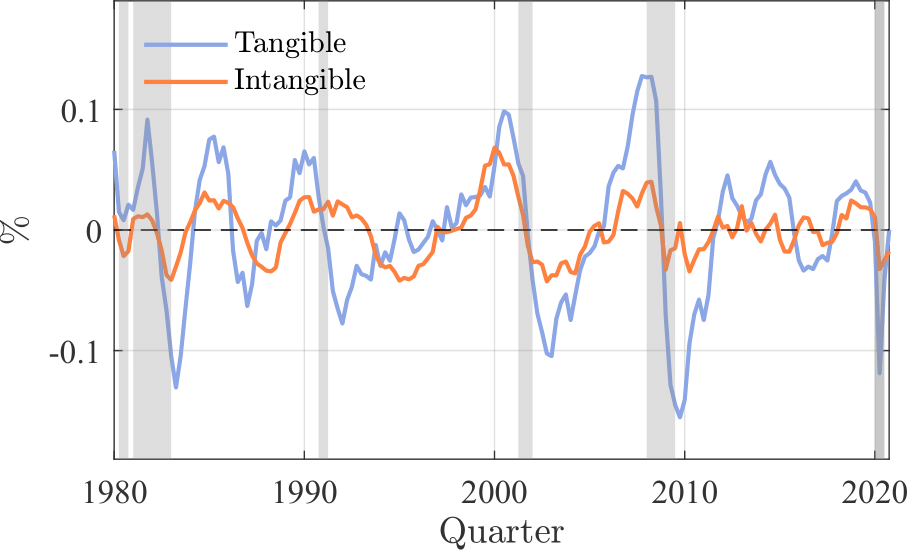

Intangible Capital, Lumpy Investment and the Business Cycle (joint with Andrea Chiavari and Sampreet Goraya)

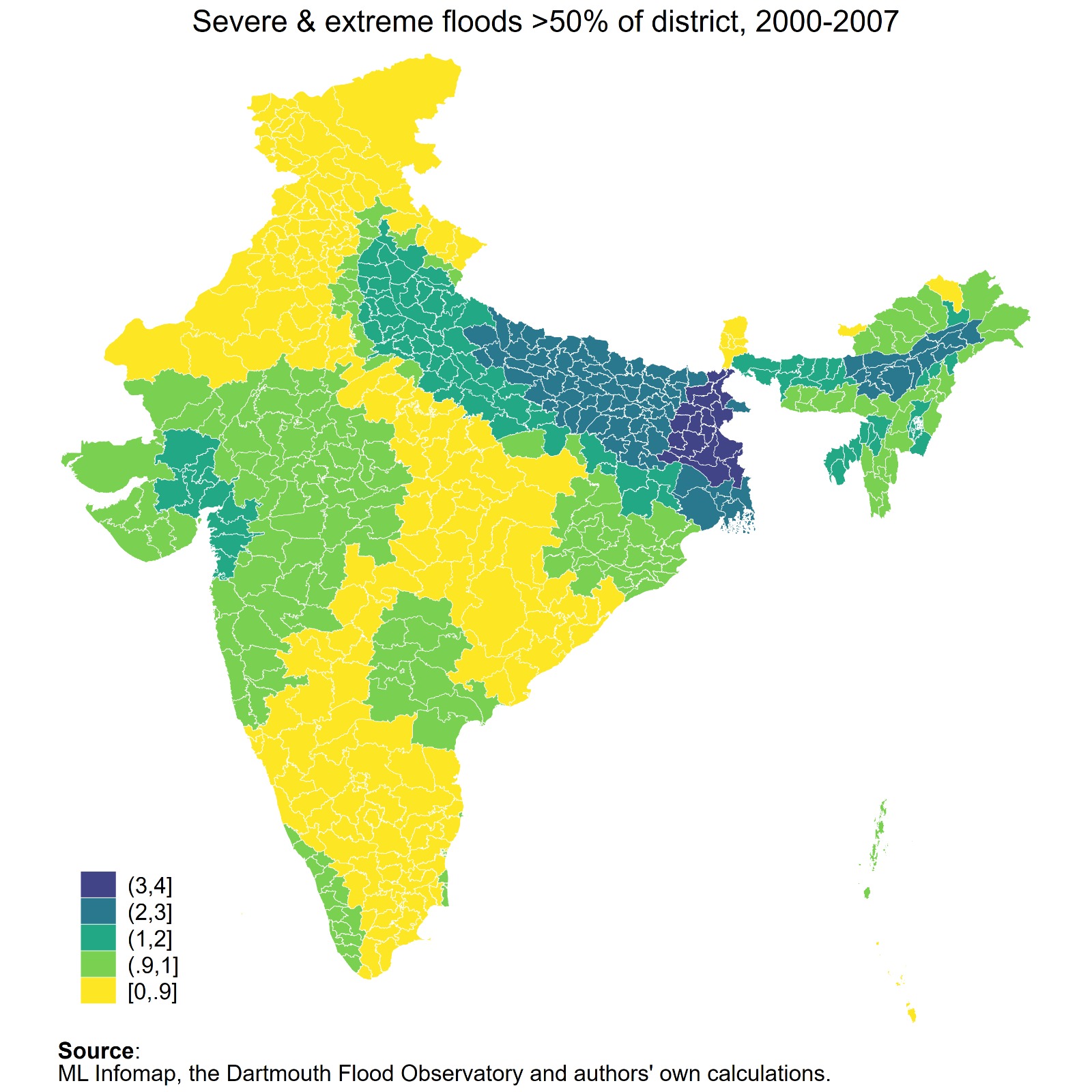

Floods and Adaptation Strategies: Evidence from Indian Manufacturing (joint with Alejandro Rábano and José Nicolás Rosas) Draft